Value at Risk

Contents

Value at Risk#

Session objectives:

Compute Value at Risk (VaR)

Empirical VaR and Expected Shortfall on empirical data

Parametric VaR using the Normal distribution assumption

Simulate stock/index level using Geometric Brownian Motion (GBM)

Simulated VaR

Backtesting a VaR

Compute expected Shortfall

1. Import packages (matplotlib, pandas, os,…) and data#

1.1 Import packages (matplotlib, pandas, os,…)#

c’est quoi un import relatif

import matplotlib.pyplot as plt

import numpy as np

import pandas as pd

import os

import statsmodels.api as sm

from scipy.stats import norm

# Remark : import all vs relative import

import math

math.sqrt(9)

3.0

from math import sqrt

sqrt(9)

3.0

1.2. Set your working directory using os.chldr (same as in the previous exercice on Volatility)#

#os.chdir(r'C:\Users\cdes1\OneDrive - ICHEC\Documents\Cours\PortfolioManagement')

os.chdir(r'/Users/christophe/OneDrive - ICHEC/Documents/Cours/PortfolioManagement')

1.3. Import and check the data#

Import the excel File

sp500_daily.xlsx. Keep data from 2010 onwards.Verify your data by showing the first five rows and the last five rows (as in the previous exercice on Volatility)

df = pd.read_excel('data/sp500_daily.xlsx', index_col=0, parse_dates=True)

df = df.loc['2010-01-01':]

df.head()

| CLOSE | |

|---|---|

| Date | |

| 2010-01-04 | 1132.9855 |

| 2010-01-05 | 1136.5234 |

| 2010-01-06 | 1137.1378 |

| 2010-01-07 | 1141.6949 |

| 2010-01-08 | 1144.9831 |

df.tail()

| CLOSE | |

|---|---|

| Date | |

| 2022-12-23 | 3844.8150 |

| 2022-12-27 | 3829.2493 |

| 2022-12-28 | 3783.2219 |

| 2022-12-29 | 3849.2832 |

| 2022-12-30 | 3839.4966 |

1.4. Compute daily log-returns in ndarray (numpy) rets to compute empirical VaR#

prices = df['CLOSE']

rets = np.log(prices / prices.shift(1))[1:]

print(rets[:10])

Date

2010-01-05 0.003118

2010-01-06 0.000540

2010-01-07 0.004000

2010-01-08 0.002876

2010-01-11 0.001742

2010-01-12 -0.009424

2010-01-13 0.008287

2010-01-14 0.002428

2010-01-15 -0.010884

2010-01-19 0.012425

Name: CLOSE, dtype: float64

Compute the number of observations (length of vector

rets)

n = len(rets)

n

3271

2. Empirical VaR#

Compute the 95% and the 99% VaR of the empirical distribustion

Use the 5th and the 1st percentile of the return distribution using the function

np.percentile([returns],q=[percentile]).The percentile should be a number between 0 and 100.

Note: the percentile 0 corresponds to the minimum, check the result with the function (

np.min) of the distribution.Note: the percentile 100 corresponds to the maximum, check the result with the function (

np.max) of the distribution.

p5 = np.percentile(rets, q=5)

print("Var(5%):", f"{p5:.4%}")

Var(5%): -1.7348%

p1=np.percentile(rets,q=1)

print("VaR(1%):",f"{p1:.4%}")

VaR(1%): -3.2953%

np.percentile(rets, q=0)

-0.12765113378213216

np.min(rets)

-0.12765113378213216

np.percentile(rets, q=100)

0.0896853763515508

np.max(rets)

0.0896853763515508

np.maximum(4, 5)

5

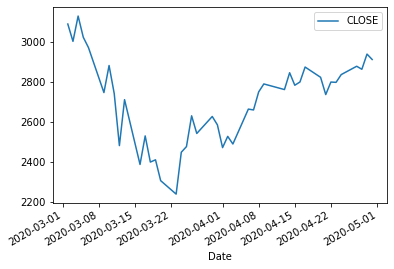

df.loc['2020-03-01':'2020-04-30'].plot()

<AxesSubplot:xlabel='Date'>

Identify when the maximum return happened

rets[rets==np.max(rets)]

Date

2020-03-24 0.089685

Name: CLOSE, dtype: float64

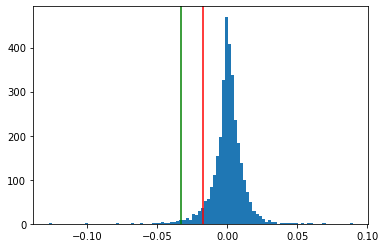

3. Represent the empirical distribution and check for Normality (To use parametric VaR)#

3.1. Represent the histogram of the return distribution#

Add the two estimated emprical VaR (95% and 99%) (with 2 vertical bars)

num_bins = 100

plt.hist(rets, bins=num_bins)

plt.axvline(x=p5, color='red')

plt.axvline(x=p1, color='green');

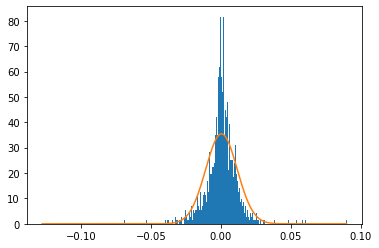

3.2. Compare the empirical ditribution with a Normal distrubution by adding a normal curve on the graph#

import scipy.stats as scs

Note : Function equivalent to =NORM.DIST(x;0;1;TRUE) in Excel

scs.norm.cdf(-1.96)

0.024997895148220435

Add a normal curve on the graph and observe the relative “Normality” of the empirical data

num_bins = 1000

plt.hist(rets, bins=num_bins, density=True);

x = np.linspace(np.min(rets), np.max(rets), 1000)

r = np.mean(rets)

pdf = scs.norm.pdf(x, loc=r, scale=np.std(rets))

#print(pdf)

plt.plot(x, pdf);

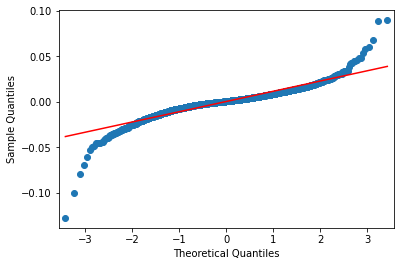

Use the qqplot to observe the compare the tails of the empiical distribution wth the tails of the Normal distribution

sm.qqplot(rets, line='s');

3.3. Test for normality#

Use the Jarque Bera test and interpret the result

\(H_0\): Data are normally distributed

\(H_1\): Data are not normally distributed

from statsmodels.stats.stattools import jarque_bera

jarque_bera(rets)

(24046.491072008783, 0.0, -0.7337810849301992, 16.201526948721195)

from scipy.stats import jarque_bera

jarque_bera(rets)

Jarque_beraResult(statistic=24046.49107200881, pvalue=0.0)

We can verify the the Jarque Bera test by coding the test step by step

Compute S

Compute K

Compute JB

from scipy.stats import skew, kurtosis

print(skew(rets))

print(kurtosis(rets))

-0.7337810849301992

13.201526948721195

m3 = np.sum((rets - np.mean(rets))**3) / n

m2 = np.sum((rets - np.mean(rets))**2) / n

Sk = m3 / m2**(3/2)

Sk

-0.7337810849301989

m4 = np.sum((rets - np.mean(rets))**4) / n

Ku = m4 / m2**2

Ku - 3

13.201526948721195

JB = n / 6 * (Sk**2 + ((Ku-3)**2)/4)

JB

24046.491072008783

Another normality test : Shapiro Wilk test#

The Shapiro-Wilk test tests the null hypothesis that the data was drawn from a normal distribution.

https://docs.scipy.org/doc/scipy/reference/generated/scipy.stats.shapiro.html

from scipy.stats import shapiro

shapiro(rets)

ShapiroResult(statistic=0.8889527916908264, pvalue=1.5694542800437951e-43)

A test for any distribution : Anderson test#

The Anderson-Darling test tests the null hypothesis that a sample is drawn from a population that follows a particular distribution. For the Anderson-Darling test, the critical values depend on which distribution is being tested against. This function works for normal, exponential, logistic, or Gumbel (Extreme Value Type I) distributions.

https://docs.scipy.org/doc/scipy/reference/generated/scipy.stats.anderson.html

from scipy.stats import anderson

anderson(rets)

AndersonResult(statistic=68.0861414366509, critical_values=array([0.575, 0.655, 0.786, 0.917, 1.091]), significance_level=array([15. , 10. , 5. , 2.5, 1. ]))

4. Compute parametric VaR (with a Normal distribution assumption)#

4.1. Compute the average daily return#

mu = np.average(rets)

print(mu)

0.0003731229227067712

4.2. Compute the daily standard deviation#

sigma = np.std(rets, ddof=1)

print(sigma)

0.011254626546227362

4.3. Compute parametric VaR#

Note : Equivalent to =NORM.INV(x;0;1) in Excel

print('99%', norm.ppf(0.01))

print('97,5%', norm.ppf(0.025))

print('95%', norm.ppf(0.05))

99% -2.3263478740408408

97,5% -1.9599639845400545

95% -1.6448536269514729

Z = norm.ppf(0.05)

mu + Z * sigma

-0.018139090371839632

p5

-0.017347574787051057

Z = norm.ppf(0.01)

mu + Z * sigma

-0.025809053616232862

p1

-0.03295346538723258

5. Simulate a data distribution with the Geometric brownian motion (GBM) to compute a VaR by Monte Carlo simulation#

df.tail()

| CLOSE | |

|---|---|

| Date | |

| 2022-12-23 | 3844.8150 |

| 2022-12-27 | 3829.2493 |

| 2022-12-28 | 3783.2219 |

| 2022-12-29 | 3849.2832 |

| 2022-12-30 | 3839.4966 |

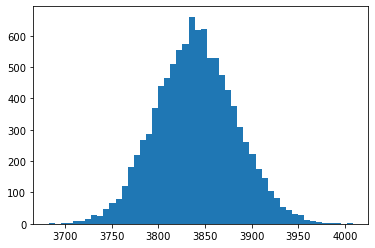

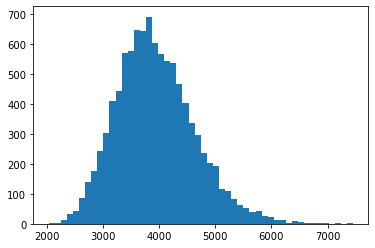

5.1. Simulate a data distribution the next day using the GBM#

Edit (23/04/23):

T=1/252 has been replaced with T=1

r is the mean value of daily return and sigma is the standard deviation of the returns (but not annualized).

np.random.seed(0)

S0 = df.iloc[-1]['CLOSE']

r = np.mean(rets)

sigma = np.std(rets)

T = 1

numSim = 10000

ST1 = S0 * np.exp((r - 0.5 * sigma**2) * T +

np.random.standard_normal(numSim) * sigma * np.sqrt(T))

plt.hist(ST1, bins=50);

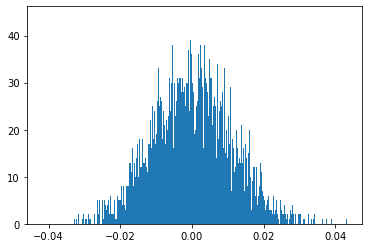

5.2. Compute the 99% VaR#

rets = np.log(ST1 / S0)

plt.hist(rets, bins=1000);

print(np.percentile(rets, q=1))

-0.02563021860323059

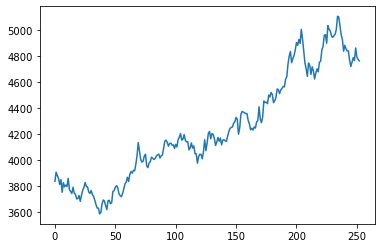

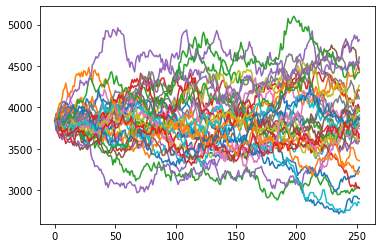

5.3. Simulate a single return trajectory on one year and a distribution in one year#

Edit (23/04/23):

mu is the mean value of daily return multiplied by 252. Therefore it represents the annual mean.

sigma is the annualized standard deviation of the returns.

np.random.seed(1)

T = 252

mu = np.mean(rets)*T # new

sigma = np.std(rets)*sqrt(T) # new

S = np.zeros(T+1)

S[0] = S0

dt = 1/252

for t in range(T):

S[t+1] = S[t] * np.exp((mu-sigma**2/2)*dt + sigma * np.random.normal(0, 1) * np.sqrt(dt))

plt.plot(S);

numSim = 10000

T = 252

dt = 1 / T

mu = np.mean(rets)*T # new

sigma = np.std(rets)*np.sqrt(T) # new

S = np.zeros((T+1, numSim))

S[0] = S0

for t in range(1, T+1):

S[t] = S[t-1] * np.exp((mu - sigma**2/2) * dt +

sigma * np.sqrt(dt) * np.random.standard_normal(numSim))

plt.hist(S[-1], bins=50);

S

array([[3839.4966 , 3839.4966 , 3839.4966 , ..., 3839.4966 ,

3839.4966 , 3839.4966 ],

[3722.30340007, 3923.22264717, 3855.31569663, ..., 3861.11194267,

3873.85568493, 3760.96120326],

[3748.39880064, 3937.33272466, 3908.94398872, ..., 3861.53992374,

3859.69168867, 3717.22701904],

...,

[2925.63745469, 3947.4365368 , 3051.6340238 , ..., 3729.83556295,

4826.42577662, 3981.43817732],

[2902.6029258 , 4000.91410254, 3031.00608792, ..., 3727.39843353,

4839.9391242 , 4008.86906069],

[2899.37229201, 3960.90670635, 3034.68939292, ..., 3717.6130952 ,

4807.63832887, 4061.56943795]])

plt.plot(S[:,:35]);

6. VaR Backtesting and the binomial distribution#

LOI.BINOMIALE(1 ; 250 ; 0.01 ; faux) = 0.205 (probability)

LOI.BINOMIALE(1 ; 250 ; 0,01 ; vrai) = 0.286 (cumulative probability)

from scipy.stats import binom

x = 1 # x succes

n = 250 # n essais

p = 0.01 # proba

binom.pmf(x, n, p) # pmf = probability mass function

0.20469322263177145

from math import factorial

def combi(n, x):

c = factorial(n)/(factorial(x)*factorial(n-x))

return c

def binomial(x, n, p):

return combi(n, x) * p**x * (1-p)**(n-x)

binomial(x, n, p)

0.2046932226317709

x = 1

n = 250

p = 0.01

binom.cdf(x, n, p)

0.28575173879395216

def Binomial(x, n, p):

b = 0

for j in range(x+1):

b += binomial(j, n, p)

return b

Binomial(x, n, p)

0.28575173879395216

LOI.BINOMIALE(4;250;0,01;faux) = 0,134 (probabilité)

LOI.BINOMIALE(4;250;0,01;vrai) = 0,892 (probabilité cumulée 0,1,2,3 et 4)

x = 4

n = 250

p = 0.01

print(binom.pmf(x, n, p))

print(binom.cdf(x, n, p))

0.13407092913874208

0.8921876269036252

x = 5

n = 250

p = 0.01

print(binom.pmf(x, n, p))

print(binom.cdf(x, n, p))

0.06662918902652627

0.9588168159301517

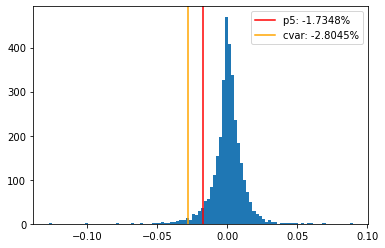

7. Conditional VaR / Expected Shortfall#

7.1. Keep the 5th data percentile and count the observations#

rets = np.log(df / df.shift(1))[1:]

rets = np.array(rets)

p5 = np.percentile(rets, q=5)

p5

-0.017347574787051057

low_returns = rets[rets < p5]

len(low_returns) / len(rets)

0.05013757260776521

7.2. Compute the average of the 5th tail data and show the ES on the distribution graph#

cvar = np.mean(low_returns)

cvar

-0.028044792302960128

plt.hist(rets, bins=100)

plt.axvline(p5, color='red', label='p5: '+f"{p5:.4%}")

plt.axvline(cvar, color='orange', label='cvar: '+f"{cvar:.4%}")

plt.legend();

References#

https://www.statsmodels.org/dev/_modules/statsmodels/stats/stattools.html

https://github.com/yhilpisch/py4fi2nd/

https://docs.scipy.org/doc/scipy/reference/generated/scipy.stats.shapiro.html

https://docs.scipy.org/doc/scipy/reference/generated/scipy.stats.anderson.html