Session 1: Introduction to portfolio management

Contents

Session 1: Introduction to portfolio management#

This notebook contains the scripts which the figures of Session 1: Introduction to Portfolio Management.

If you want a step-by-step guide, please refer to Tutorial 1 (Moodle).

import matplotlib.pyplot as plt

import numpy as np

import os

import pandas as pd

import statsmodels.api as sm

import warnings

warnings.filterwarnings("ignore")

os.chdir(r'/Users/christophe/OneDrive - ICHEC/Documents/Cours/PortfolioManagement')

from scripts.utils import compute_portfolio_rets, compute_portfolio_volatility

from scripts.utils import annualize_rets

%load_ext autoreload

%autoreload 2

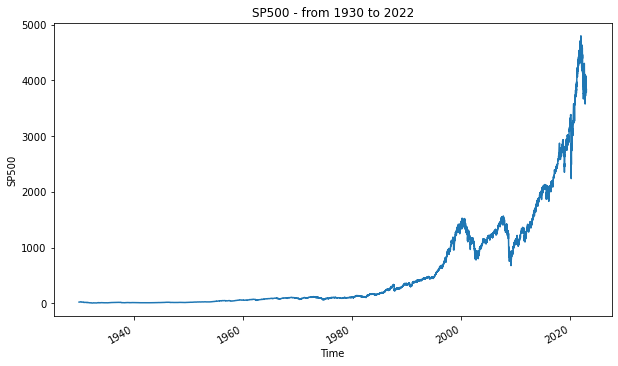

S&P500 (daily)#

df = pd.read_excel('data/sp500_daily.xlsx', sheet_name='data',

parse_dates=True, index_col=0)

fig, ax = plt.subplots(figsize=(10,6))

ax = df['CLOSE'].plot()

plt.title('SP500 - from 1930 to 2022')

plt.xlabel('Time')

plt.ylabel('SP500')

plt.savefig('images/01_sp500.png')

plt.show()

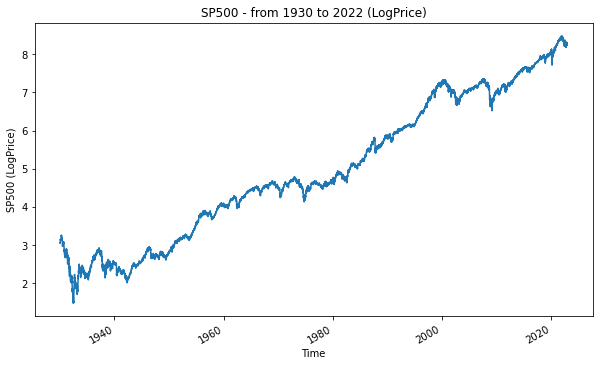

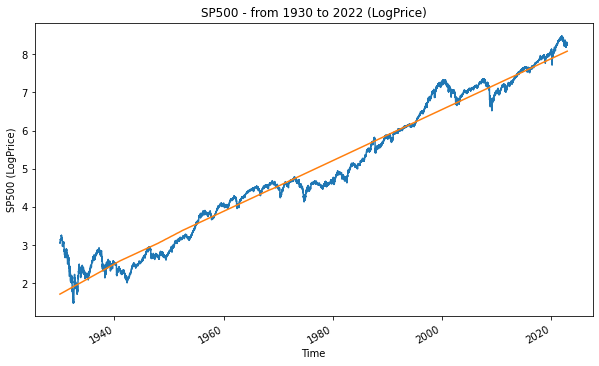

df['LogPrice'] = np.log(df['CLOSE'])

fig, ax = plt.subplots(figsize=(10,6))

ax = df['LogPrice'].plot()

plt.title('SP500 - from 1930 to 2022 (LogPrice)')

plt.xlabel('Time')

plt.ylabel('SP500 (LogPrice)')

plt.savefig('images/01_sp500_log.png')

plt.show()

# fit linear trend line

X = np.arange(1, len(df.index)+1)

Y = np.array(df['LogPrice']).reshape(-1, 1)

X = sm.add_constant(X)

results = sm.OLS(Y,X).fit()

df['Trend'] = results.params @ X.T

fig, ax = plt.subplots(figsize=(10,6))

ax = df['LogPrice'].plot()

ax = df['Trend'].plot()

plt.title('SP500 - from 1930 to 2022 (LogPrice)')

plt.xlabel('Time')

plt.ylabel('SP500 (LogPrice)')

plt.savefig('images/01_sp500_log_trend.png')

plt.show()

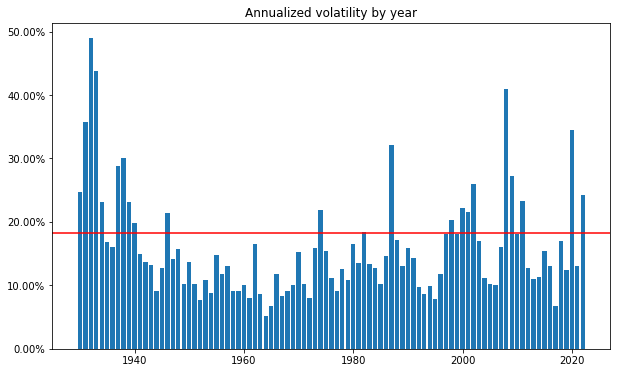

Yearly volatilities#

df = pd.read_excel('data/sp500_daily.xlsx', index_col=0, parse_dates=True)

frequency = 252

rets = pd.DataFrame(df['CLOSE'].pct_change().dropna())

mean_vol = rets['CLOSE'].std() * np.sqrt(frequency)

rets['Year'] = rets.index.year

annual_vols = rets.groupby('Year').std() * np.sqrt(frequency)

# plot

fig, ax = plt.subplots(figsize=(10, 6))

ax.bar(annual_vols.index, annual_vols['CLOSE'])

plt.axhline(mean_vol, color='r')

ax.set_title('Annualized volatility by year')

vals = ax.get_yticks()

ax.set_yticklabels(['{:,.2%}'.format(x) for x in vals])

plt.savefig('images/01_annual_volatily.png')

plt.show()

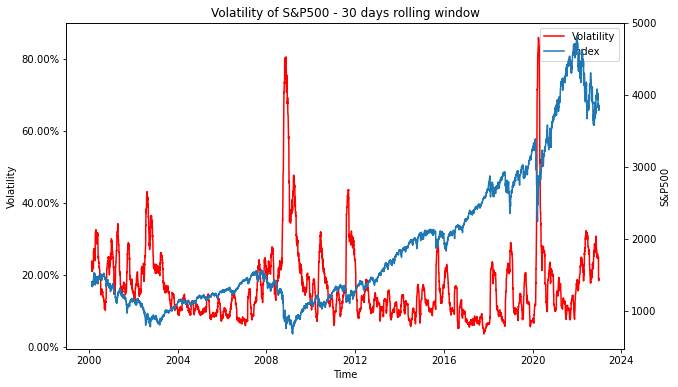

Rolling volatility#

df = pd.read_excel('data/sp500_daily.xlsx', index_col=0, parse_dates=True)

df = df.loc['2000-01-01':]

df.rename(columns={'CLOSE': 'SP500'}, inplace=True)

rets = np.log(df / df.shift(1)).dropna()

window = 30

rol_vol = rets['SP500'].rolling(window).std() * np.sqrt(252)

fig = plt.figure(figsize=(10, 6))

ax = fig.add_subplot(111)

line1 = ax.plot(rol_vol.index, rol_vol, color='r', label='Volatility')

ax2 = ax.twinx()

line2 = ax2.plot(df.index[window:], df['SP500'][window:], label='Index')

lines = line1 + line2

labs = [l.get_label() for l in lines]

ax.legend(lines, labs, loc=0)

ax.set_title(f'Volatility of S&P500 - {window} days rolling window')

ax.set_xlabel('Time')

ax.set_ylabel('Volatility')

ax2.set_ylabel('S&P500')

vals = ax.get_yticks()

ax.set_yticklabels(['{:,.2%}'.format(x) for x in vals])

plt.savefig('images/01_rolling_volatility.png')

plt.show()

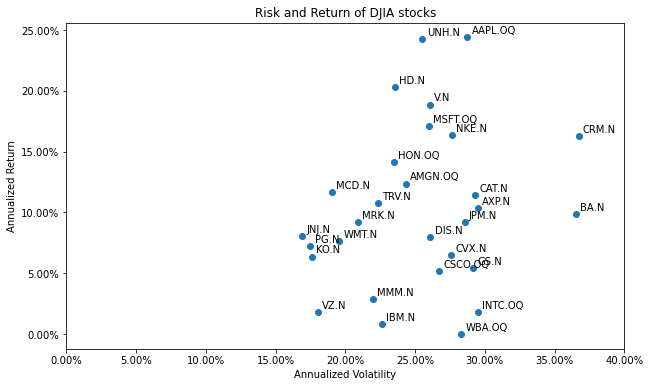

DJIA (daily)#

prices_daily = pd.read_excel('data/DJIA_daily.xlsx',

sheet_name='prices',

index_col=0,

parse_dates=True)

frequency = 252

rets_daily = prices_daily.pct_change().dropna()

df = prices_daily.iloc[-1] / prices_daily.iloc[0] - 1

df = pd.DataFrame(df)

df.rename(columns={0: 'HPR'}, inplace=True)

df['AnnualizedRets'] = (df['HPR']+1)**(frequency/rets_daily.shape[0]) - 1

df['AnnualizedVolatility'] = rets_daily.std() * np.sqrt(frequency)

df.head()

| HPR | AnnualizedRets | AnnualizedVolatility | |

|---|---|---|---|

| GS.N | 0.983938 | 0.054197 | 0.291412 |

| NKE.N | 6.162050 | 0.163785 | 0.276192 |

| CSCO.OQ | 0.929526 | 0.051941 | 0.267201 |

| JPM.N | 2.129522 | 0.091873 | 0.285460 |

| DIS.N | 1.709074 | 0.079804 | 0.260958 |

fig, ax = plt.subplots(figsize=(10, 6))

ax.scatter(df['AnnualizedVolatility'], df['AnnualizedRets'])

ax.set_xlim((0, 0.4))

ax.set_xlabel('Annualized Volatility')

ax.set_ylabel('Annualized Return')

ax.set_title('Risk and Return of DJIA stocks')

# Loop for annotation of all points

for i in range(df.shape[0]):

plt.annotate(df.index[i], (df.iloc[i]['AnnualizedVolatility']+0.003,

df.iloc[i]['AnnualizedRets']+0.003))

vals = ax.get_yticks()

ax.set_yticklabels(['{:,.2%}'.format(x) for x in vals])

vals = ax.get_xticks()

ax.set_xticklabels(['{:,.2%}'.format(x) for x in vals])

plt.savefig('images/01_risk_return_djia_stocks.png')

plt.show()

Portfolio: 2 stocks#

df = pd.read_excel('data/DJIA_monthly.xlsx', index_col=0,

parse_dates=True, sheet_name='prices')

frequency = 12

stocks = df.columns[:2]

prices = df[stocks]

rets = prices.pct_change().dropna()

AnnR = annualize_rets(rets, frequency)

weights = np.repeat(1/len(stocks), len(stocks))

portfolio_rets = AnnR @ weights

portfolio_vol = compute_portfolio_volatility(weights, rets)

print('Portfolio return', round(portfolio_rets, 4))

print('Portfolio volatility', round(portfolio_vol, 4))

Portfolio return 0.1169

Portfolio volatility 0.2262

Portfolio with N stocks#

df = pd.read_excel('data/DJIA_monthly.xlsx', index_col=0,

parse_dates=True, sheet_name='prices')

frequency = 12

stocks = df.columns[:3]

prices = df[stocks]

rets = prices.pct_change().dropna()

AnnR = annualize_rets(rets, frequency)

weights = np.repeat(1/len(stocks), len(stocks))

portfolio_rets = AnnR @ weights

portfolio_vol = compute_portfolio_volatility(weights, rets)

print('Portfolio return', round(portfolio_rets, 4))

print('Portfolio volatility', round(portfolio_vol, 4))

Portfolio return 0.0979

Portfolio volatility 0.21

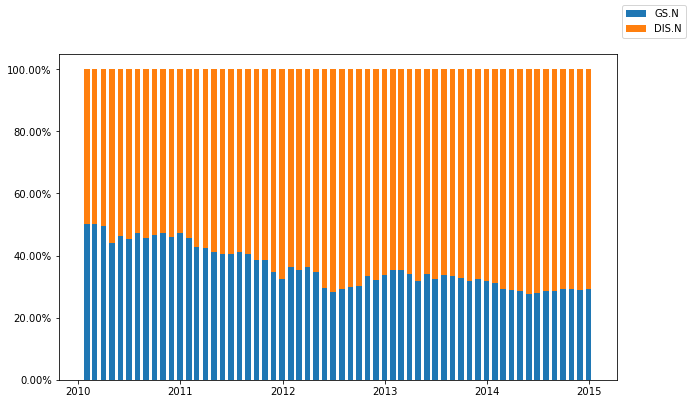

Portfolio weights#

n1 = 20

n2 = 100

stock1 = 'GS.N'

stock2 = 'DIS.N'

start_date = '2010-01-01'

end_date = '2015-01-01'

df = pd.read_excel('data/DJIA_monthly.xlsx', index_col=0, parse_dates=True)

df = df.loc[start_date:end_date]

df = df[[stock1, stock2]]

df['Portfolio'] = n1 * df[stock1] + n2 * df[stock2]

df['w1'] = n1 * df[stock1] / df['Portfolio']

df['w2'] = n2 * df[stock2] / df['Portfolio']

width = 20

fig, ax = plt.subplots(figsize=(10, 6))

ax.bar(df.index, df['w1'], width=width, label=stock1)

ax.bar(df.index, df['w2'], bottom=df['w1'], width=width, label=stock2)

vals = ax.get_yticks()

ax.set_yticklabels(['{:,.2%}'.format(x) for x in vals])

fig.legend(loc="upper right")

plt.savefig('images/01_weights.png')

plt.show()