Session 2: Portfolio optimization

Contents

Session 2: Portfolio optimization#

This notebook contains the scripts needed to generate the figures of Session 2: Portfolio optimization.

If you want a step-by-step guide, please refer to Tutorial 1 (Moodle).

import matplotlib.pyplot as plt

import numpy as np

import os

import pandas as pd

import scipy.optimize as sco

import warnings

warnings.filterwarnings("ignore")

os.chdir(r'/Users/christophe/OneDrive - ICHEC/Documents/Cours/PortfolioManagement')

from scripts.utils import compute_portfolio_volatility, compute_portfolio_rets

from scripts.utils import annualize_rets

%load_ext autoreload

%autoreload 2

Minimum variance portfolio#

A particular portfolio is the minimum variance portfolio. This optimization problem consists in finding the weights such that the portfolio will have the minimum variance.

2 stocks#

Before the optimization, let’s create an equally-weighted portfolio to have a benchmark to compare with. With \(N\) stocks, the equally-weighted weight is therefore \(1/N\).

df = pd.read_excel('data/DJIA_monthly.xlsx',

index_col=0,

parse_dates=True,

sheet_name='prices')

frequency = 12

stock1 = df.columns[0]

stock2 = df.columns[1]

stocks = [stock1, stock2]

rets = df[stocks].pct_change().dropna()

AnnR = annualize_rets(rets, frequency)

cov = rets.cov(ddof=1)

weights = np.repeat(1/len(stocks), len(stocks))

portfolio_rets = AnnR @ weights

portfolio_vol = compute_portfolio_volatility(weights, rets)

print('Stock 1:', stock1)

print('Stock 2:', stock2)

print('Portfolio R:', '{:,.2%}'.format(portfolio_rets))

print('Portfolio V:', '{:,.2%}'.format(portfolio_vol))

Stock 1: GS.N

Stock 2: NKE.N

Portfolio R: 11.69%

Portfolio V: 22.62%

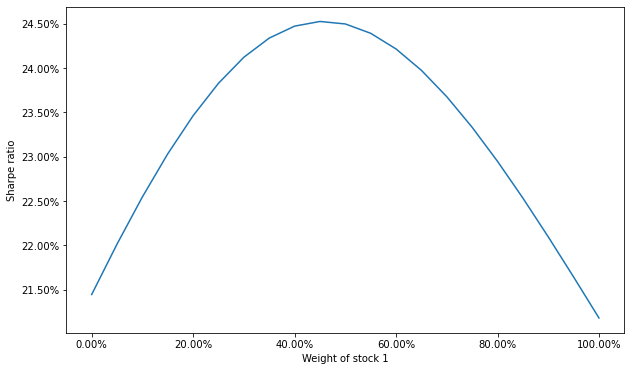

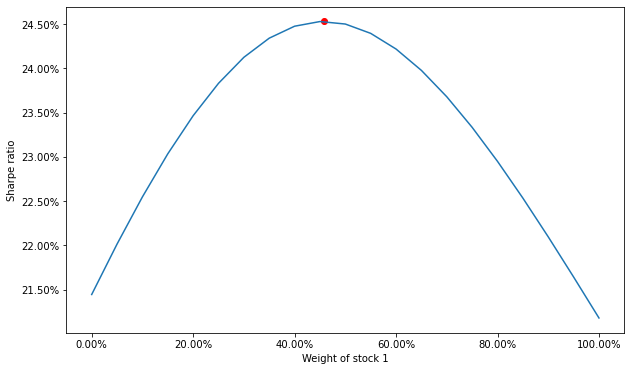

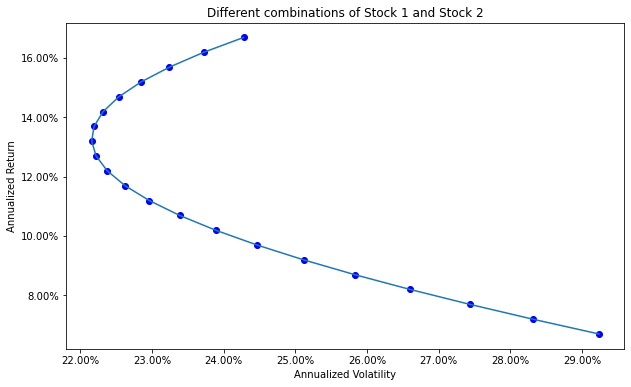

We can also “naively” compute the portfolio return and the portfolio volatility for different weights.

weights = np.arange(0.0, 1.01, 0.05)

Vols = []

Rets = []

print('%9s %9s %9s %9s' % ('w_1', 'w_2', 'sigma', 'rets'))

print(40 * '-')

for weight in weights:

W = np.array([weight, 1-weight])

r = AnnR @ W

vol = compute_portfolio_volatility(W, rets)

Vols.append(vol)

Rets.append(r)

msg = '{:10.2%}'.format(W[0])

msg+= '{:10.2%}'.format(W[1])

msg+= '{:10.2%}'.format(vol)

msg+= '{:10.2%}'.format(r)

print(msg)

w_1 w_2 sigma rets

----------------------------------------

0.00% 100.00% 24.28% 16.69%

5.00% 95.00% 23.72% 16.19%

10.00% 90.00% 23.24% 15.69%

15.00% 85.00% 22.85% 15.19%

20.00% 80.00% 22.54% 14.69%

25.00% 75.00% 22.32% 14.19%

30.00% 70.00% 22.19% 13.69%

35.00% 65.00% 22.16% 13.19%

40.00% 60.00% 22.22% 12.69%

45.00% 55.00% 22.38% 12.19%

50.00% 50.00% 22.62% 11.69%

55.00% 45.00% 22.96% 11.19%

60.00% 40.00% 23.38% 10.69%

65.00% 35.00% 23.89% 10.19%

70.00% 30.00% 24.47% 9.69%

75.00% 25.00% 25.11% 9.19%

80.00% 20.00% 25.83% 8.69%

85.00% 15.00% 26.60% 8.19%

90.00% 10.00% 27.43% 7.69%

95.00% 5.00% 28.31% 7.19%

100.00% 0.00% 29.24% 6.69%

fig, ax = plt.subplots(figsize=(10,6))

ax.plot(Vols, Rets)

ax.scatter(Vols, Rets, color='blue')

plt.title('Different combinations of Stock 1 and Stock 2')

plt.xlabel('Annualized Volatility')

plt.ylabel('Annualized Return')

vals = ax.get_yticks()

ax.set_yticklabels(['{:,.2%}'.format(x) for x in vals])

vals = ax.get_xticks()

ax.set_xticklabels(['{:,.2%}'.format(x) for x in vals])

plt.savefig('images/efficient_frontier_2stocks.png')

plt.show();

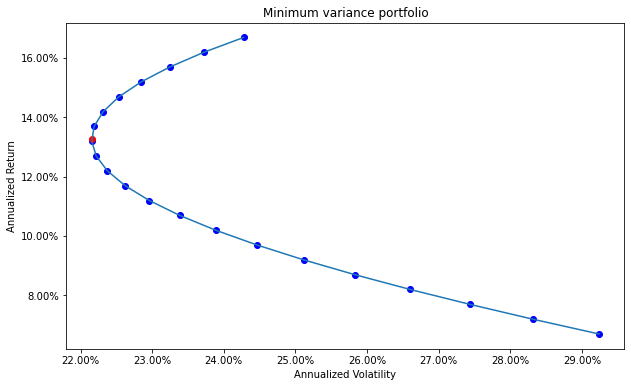

First method (derivatives)#

Take the derivative of the function and set it to zero.

The solution is:

and

var1 = cov[stock1][stock1]

var2 = cov[stock2][stock2]

cov12 = cov[stock1][stock2]

w1 = (var2 - cov12) / (var1 + var2 - 2*cov12)

w2 = 1 - w1

weights = np.array([w1, w2])

r_min_vol = AnnR @ weights

min_vol = compute_portfolio_volatility(weights, rets)

print('Weight 1:', '{:,.2%}'.format(w1))

print('Weight 2:', '{:,.2%}'.format(w2))

print('Portfolio R:', '{:,.2%}'.format(portfolio_rets))

print('Portfolio V:', '{:,.2%}'.format(portfolio_vol))

Weight 1: 34.22%

Weight 2: 65.78%

Portfolio R: 11.69%

Portfolio V: 22.62%

fig, ax = plt.subplots(figsize=(10,6))

ax.plot(Vols, Rets)

ax.scatter(Vols, Rets, color='blue')

ax.scatter(min_vol, r_min_vol, color='red')

plt.title('Minimum variance portfolio')

plt.xlabel('Annualized Volatility')

plt.ylabel('Annualized Return')

vals = ax.get_yticks()

ax.set_yticklabels(['{:,.2%}'.format(x) for x in vals])

vals = ax.get_xticks()

ax.set_xticklabels(['{:,.2%}'.format(x) for x in vals])

plt.savefig('images/02_minimum_variance_portfolio.png')

plt.show();

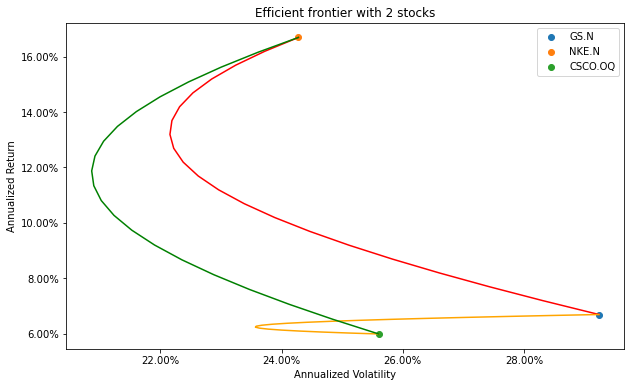

N stocks#

Before the optimization, let’s create an equally-weighted portfolio to have a benchmark to compare with. With \(N\) stocks, the equally-weighted weight is therefore \(1/N\).

df = pd.read_excel('data/DJIA_monthly.xlsx',

index_col=0,

parse_dates=True,

sheet_name='prices')

frequency = 12

stock1 = df.columns[0]

stock2 = df.columns[1]

stock3 = df.columns[2]

stocks = [stock1, stock2, stock3]

rets = df[stocks].pct_change().dropna()

AnnR = annualize_rets(rets, frequency)

cov = rets.cov(ddof=1)

weights = np.repeat(1/len(stocks), len(stocks))

portfolio_rets = AnnR @ weights

portfolio_vol = compute_portfolio_volatility(weights, rets)

print('Stock 1:', stock1)

print('Stock 2:', stock2)

print('Stock 3:', stock3)

print('Portfolio R:', '{:,.2%}'.format(portfolio_rets))

print('Portfolio V:', '{:,.2%}'.format(portfolio_vol))

Stock 1: GS.N

Stock 2: NKE.N

Stock 3: CSCO.OQ

Portfolio R: 9.79%

Portfolio V: 21.00%

def generate_efficient_frontier(s1, s2, rets):

W = np.arange(0.0, 1.01, 0.05)

Vols = []

Rets = []

for w in W:

weights = np.array([w, 1-w])

r = AnnR[[s1, s2]] @ weights

vol = compute_portfolio_volatility(weights, rets[[s1, s2]])

Vols.append(vol)

Rets.append(r)

return Vols, Rets

V1, R1 = generate_efficient_frontier(stock1, stock2, rets)

V2, R2 = generate_efficient_frontier(stock1, stock3, rets)

V3, R3 = generate_efficient_frontier(stock2, stock3, rets)

fig, ax = plt.subplots(figsize=(10,6))

ax.plot(V1, R1, color='red')

ax.plot(V2, R2, color='orange')

ax.plot(V3, R3, color='green')

cov = rets.cov()

for i in range(3):

for j in range(3):

if i == j:

v = cov[stocks[i]][stocks[i]]**0.5*np.sqrt(frequency)

r = AnnR[stocks[i]]

plt.scatter(v, r, label=stocks[i])

plt.title('Efficient frontier with 2 stocks')

plt.xlabel('Annualized Volatility')

plt.ylabel('Annualized Return')

plt.legend()

vals = ax.get_yticks()

ax.set_yticklabels(['{:,.2%}'.format(x) for x in vals])

vals = ax.get_xticks()

ax.set_xticklabels(['{:,.2%}'.format(x) for x in vals])

plt.savefig('images/02_efficient_frontier_2by2.png')

plt.show();

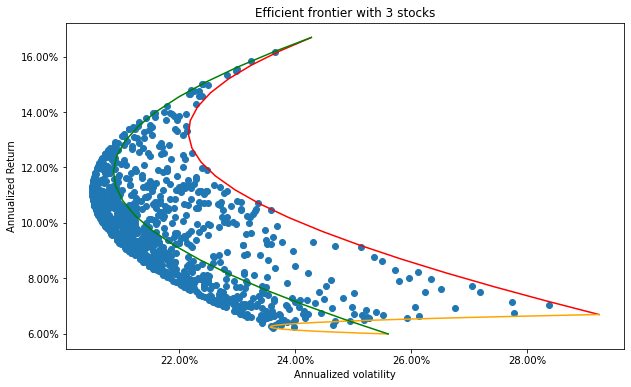

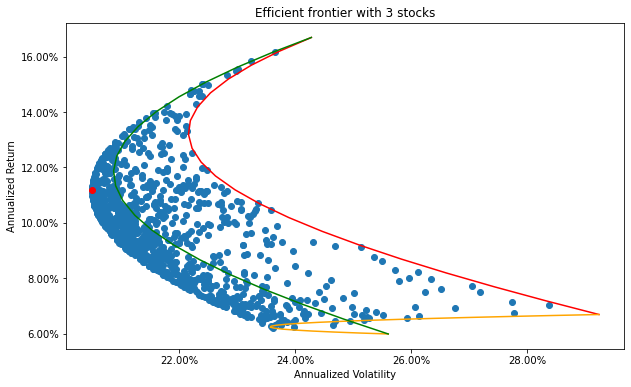

Random weights#

What happens if we create a portfolio with 3 stocks? Let’s generate 1,000 simulations with random weights for the 3 stocks. We ensure that these weights sum to one.

W = np.arange(0.0, 1.01, 0.05)

Vols = []

Rets = []

AnnR = annualize_rets(rets, frequency)

for i in range(1000):

weights = np.random.random(3)

weights /= np.sum(weights)

r = AnnR @ weights

vol = compute_portfolio_volatility(weights, rets)

Vols.append(vol)

Rets.append(r)

fig, ax = plt.subplots(figsize=(10,6))

plt.plot(V1, R1, color='red');

plt.plot(V2, R2, color='orange');

plt.plot(V3, R3, color='green');

plt.scatter(Vols, Rets)

plt.title('Efficient frontier with 3 stocks')

plt.xlabel('Annualized volatility')

plt.ylabel('Annualized Return')

vals = ax.get_yticks()

ax.set_yticklabels(['{:,.2%}'.format(x) for x in vals])

vals = ax.get_xticks()

ax.set_xticklabels(['{:,.2%}'.format(x) for x in vals])

plt.savefig('images/efficient_frontier_3stocks.png')

plt.show()

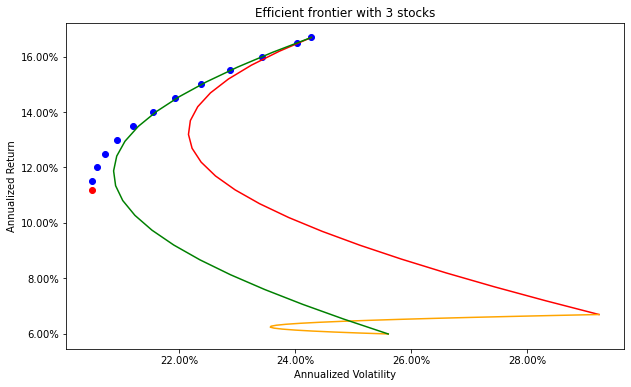

Analytical solution#

def minimum_variance_portfolio(rets):

n = rets.shape[1]

ones = np.ones(n).reshape((-1, 1))

cov = np.cov(np.array(rets).T)

num = np.linalg.inv(cov) @ ones

den = ones.T @ np.linalg.inv(cov) @ ones

opt_weights = num / den

return opt_weights.ravel()

opt_weights = minimum_variance_portfolio(rets)

portfolio_rets = AnnR @ opt_weights

portfolio_vol = compute_portfolio_volatility(opt_weights, rets)

for i in range(len(opt_weights)):

print(f'Stock {i+1}:', '{:,.2%}'.format(opt_weights[i]))

print('Portfolio R:', '{:,.2%}'.format(portfolio_rets))

print('Portfolio V:', '{:,.2%}'.format(portfolio_vol))

Stock 1: 16.06%

Stock 2: 47.45%

Stock 3: 36.49%

Portfolio R: 11.18%

Portfolio V: 20.49%

gmv_weights = minimum_variance_portfolio(rets)

gmv_weights = gmv_weights.ravel()

gmv_vol = compute_portfolio_volatility(gmv_weights, rets)

AnnR = annualize_rets(rets, frequency)

gmv_rets = AnnR @ gmv_weights

fig, ax = plt.subplots(figsize=(10,6))

plt.plot(V1, R1, color='red');

plt.plot(V2, R2, color='orange');

plt.plot(V3, R3, color='green');

plt.scatter(Vols, Rets)

plt.scatter(gmv_vol, gmv_rets, color='red')

plt.title('Efficient frontier with 3 stocks')

plt.xlabel('Annualized Volatility')

plt.ylabel('Annualized Return')

vals = ax.get_yticks()

ax.set_yticklabels(['{:,.2%}'.format(x) for x in vals])

vals = ax.get_xticks()

ax.set_xticklabels(['{:,.2%}'.format(x) for x in vals])

plt.savefig('images/efficient_frontier_3stocks_gmv.png')

plt.show()

Numerical optimization#

n = rets.shape[1]

cons = ({'type': 'eq', 'fun':lambda x: np.sum(x) - 1})

bnds = tuple((0,1) for x in range(n))

init_weights = np.repeat(1.0/n, n)

opts = sco.minimize(compute_portfolio_volatility,

init_weights,

method='SLSQP',

bounds=bnds,

args=(rets),

constraints=cons,

tol=1e-15)

print(opts)

fun: 0.20487438241457684

jac: array([0.20487438, 0.20487438, 0.20487439])

message: 'Optimization terminated successfully'

nfev: 40

nit: 10

njev: 10

status: 0

success: True

x: array([0.16058805, 0.47447539, 0.36493656])

opt_weights = opts.x

portfolio_rets = AnnR @ opt_weights

portfolio_vol = compute_portfolio_volatility(opt_weights, rets)

for i in range(len(opt_weights)):

print(f'Stock {i+1}:', '{:,.2%}'.format(opt_weights[i]))

print('Portfolio R:', '{:,.2%}'.format(portfolio_rets))

print('Portfolio V:', '{:,.2%}'.format(portfolio_vol))

Stock 1: 16.06%

Stock 2: 47.45%

Stock 3: 36.49%

Portfolio R: 11.18%

Portfolio V: 20.49%

Efficient frontier#

Can also be viewed as minimizing the variance of the portfolio with an additional constraint on the expected return:

def minimum_variance_portfolio(rets, ReturnConstraint=None):

n = rets.shape[1]

AnnRets = annualize_rets(rets, frequency)

if ReturnConstraint is None:

cons = ({'type': 'eq', 'fun': lambda x: np.sum(x) - 1})

else:

cons = ({'type': 'eq', 'fun': lambda x: np.sum(x) - 1},

{'type': 'eq', 'fun': lambda x: x @ AnnRets - ReturnConstraint })

bnds = tuple((0,1) for x in range(n))

init_weights = np.repeat(1.0/n, n)

opts = sco.minimize(compute_portfolio_volatility,

init_weights,

method='SLSQP',

bounds=bnds,

args=(rets),

constraints=cons,

tol=1e-15)

return opts.x

Optimization without constraint on the portfolio return

opt_weights = minimum_variance_portfolio(rets)

portfolio_rets = AnnR @ opt_weights

portfolio_vol = compute_portfolio_volatility(opt_weights, rets)

portfolio_sr = sharpe_ratio(opt_weights, rets, rf)

for i in range(len(opt_weights)):

print(f'Stock {i+1}:', '{:,.2%}'.format(opt_weights[i]))

print('Portfolio R:', '{:,.2%}'.format(portfolio_rets))

print('Portfolio V:', '{:,.2%}'.format(portfolio_vol))

print('Portfolio SR:', '{:,.4}'.format(portfolio_sr))

Stock 1: 16.06%

Stock 2: 47.45%

Stock 3: 36.49%

Portfolio R: 11.18%

Portfolio V: 20.49%

Portfolio SR: 0.5213

portfolio_sr

0.5212687515403356

Optimization with constraint on the portfolio return

opt_weights = minimum_variance_portfolio(rets, ReturnConstraint=0.14)

portfolio_rets = AnnR @ opt_weights

portfolio_vol = compute_portfolio_volatility(opt_weights, rets)

portfolio_sr = sharpe_ratio(opt_weights, rets, rf)

for i in range(len(opt_weights)):

print(f'Stock {i+1}:', '{:,.2%}'.format(opt_weights[i]))

print('Portfolio R:', '{:,.2%}'.format(portfolio_rets))

print('Portfolio V:', '{:,.2%}'.format(portfolio_vol))

print('Portfolio SR:', '{:,.4}'.format(portfolio_sr))

Stock 1: 5.80%

Stock 2: 74.48%

Stock 3: 19.72%

Portfolio R: 14.00%

Portfolio V: 21.54%

Portfolio SR: 0.6268

fig, ax = plt.subplots(figsize=(10,6))

plt.plot(V1, R1, color='red');

plt.plot(V2, R2, color='orange');

plt.plot(V3, R3, color='green');

gmv_weights = minimum_variance_portfolio(rets)

gmv_weights = gmv_weights.ravel()

gmv_vol = compute_portfolio_volatility(gmv_weights, rets)

gmv_ret = AnnR @ gmv_weights

plt.scatter(gmv_vol, gmv_ret, color='red')

for r_bar in np.arange(0.115, 0.17, 0.005):

w_tmp = minimum_variance_portfolio(rets,

ReturnConstraint=r_bar)

w_vol = compute_portfolio_volatility(w_tmp, rets)

w_ret = AnnR @ w_tmp

plt.scatter(w_vol, w_ret, color='blue')

plt.title('Efficient frontier with 3 stocks')

ax.set_xlabel('Annualized Volatility')

ax.set_ylabel('Annualized Return')

vals = ax.get_yticks()

ax.set_yticklabels(['{:,.2%}'.format(x) for x in vals])

vals = ax.get_xticks()

ax.set_xticklabels(['{:,.2%}'.format(x) for x in vals])

plt.savefig('images/02_efficient_frontier_3stocks_gmv.png')

plt.show()

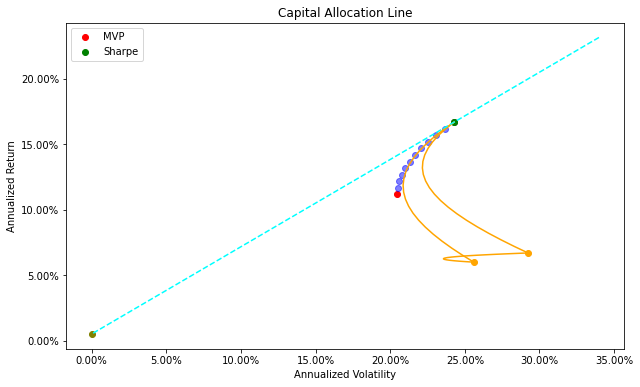

Capital allocation line#

fig, ax = plt.subplots(figsize=(10,6))

# Individual stocks

for stock in stocks:

vol = rets[stock].std() * np.sqrt(frequency)

ret = (1+rets[stock]).prod()**(frequency/rets.shape[0]) - 1

ax.scatter(vol, ret, color='orange')

# Efficient frontiers 2 by 2

V1, R1 = generate_efficient_frontier(stock1, stock2, rets=rets)

V2, R2 = generate_efficient_frontier(stock1, stock3, rets=rets)

V3, R3 = generate_efficient_frontier(stock2, stock3, rets=rets)

ax.plot(V1, R1, color='orange')

ax.plot(V2, R2, color='orange')

ax.plot(V3, R3, color='orange')

# Global minimum variance

gmv_weights = minimum_variance_portfolio(rets)

gmv_weights = gmv_weights.ravel()

gmv_vol = compute_portfolio_volatility(gmv_weights, rets)

gmv_ret = AnnR @ gmv_weights

plt.scatter(gmv_vol, gmv_ret, color='red', label='MVP')

# Efficient frontier

# Global minimum variance with return constraint

for r_bar in np.arange(gmv_ret+0.005, 0.17, 0.005):

w_tmp = minimum_variance_portfolio(rets, ReturnConstraint=r_bar)

w_vol = compute_portfolio_volatility(w_tmp, rets)

w_ret = AnnR @ w_tmp

plt.scatter(w_vol, w_ret, color='blue', alpha=0.5)

# Optimal sharpe ratio

sharpe_w = sharpe_numerical(rets, rf, short_selling=False)

sharpe_vol = compute_portfolio_volatility(sharpe_w, rets)

sharpe_ret = AnnR @ sharpe_w

plt.scatter(sharpe_vol, sharpe_ret, label='Sharpe', color='green')

# capital allocation line

plt.scatter(0, rf, color='olive')

CAL_x = []

CAL_y = []

for weight in np.arange(-0.4, 1.01, 0.10):

vol = (1-weight) * sharpe_vol

ret = weight * rf + (1-weight) * sharpe_ret

CAL_x.append(vol)

CAL_y.append(ret)

plt.plot(CAL_x, CAL_y, linestyle='dashed', color='cyan')

plt.title('Capital Allocation Line')

ax.set_xlabel('Annualized Volatility')

ax.set_ylabel('Annualized Return')

vals = ax.get_yticks()

ax.set_yticklabels(['{:,.2%}'.format(x) for x in vals])

vals = ax.get_xticks()

ax.set_xticklabels(['{:,.2%}'.format(x) for x in vals])

plt.legend(loc=0)

plt.savefig('images/02_capital_allocation_line.png')

plt.show()

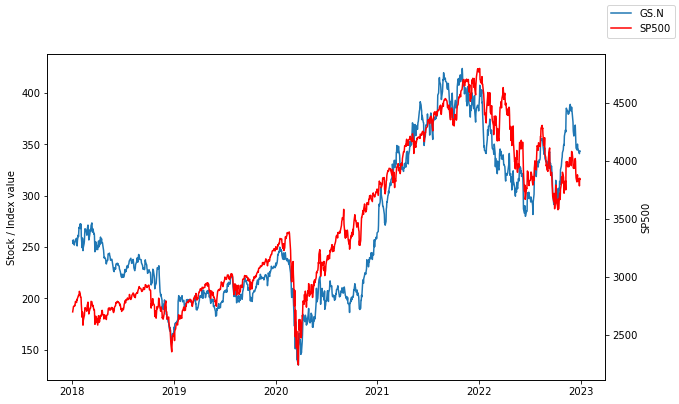

Stock beta#

The beta of a stock is computed as the covariance between the stock’s excess return (\(R^e_i\)) and the excess market return (\(R^e_m\)) divided by the variance of the market return:

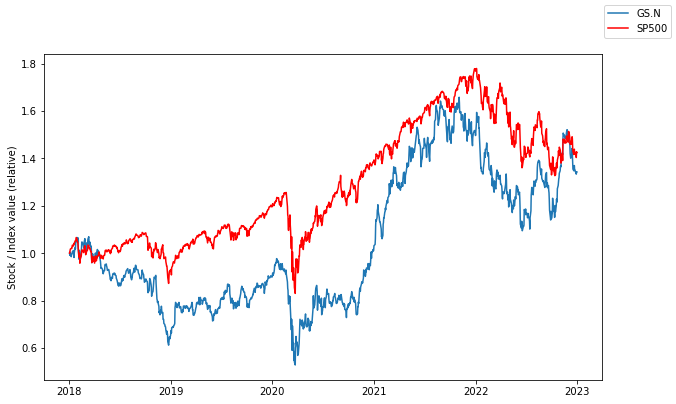

start_date = '2017-12-31'

sp500 = pd.read_excel('data/sp500_daily.xlsx', index_col=0, parse_dates=True, sheet_name='hloc')

stocks = pd.read_excel('data/DJIA_daily.xlsx', index_col=0, parse_dates=True, sheet_name='prices')

# starting at specific time

stocks = stocks.loc[start_date:]

sp500 = sp500.loc[start_date:]

sp500.rename(columns={'Close': 'SP500'}, inplace=True)

df = pd.concat([sp500, stocks], axis=1)

# plot

fig, ax = plt.subplots(figsize=(10, 6))

ax.plot(df.index, df['GS.N'], label='GS.N')

ax2 = ax.twinx()

ax2.plot(df.index, df['SP500'], label='SP500', color='red')

fig.legend(loc="upper right")

ax.set_ylabel('Stock / Index value')

ax2.set_ylabel('SP500')

plt.savefig('images/02_sp500_gsn.png')

plt.show()

# price normalization

prices_norm = df / df.iloc[0]

# plot

fig, ax = plt.subplots(figsize=(10, 6))

ax.plot(prices_norm.index, prices_norm['GS.N'], label='GS.N')

ax.plot(prices_norm.index, prices_norm['SP500'], label='SP500', color='red')

fig.legend(loc="upper right")

ax.set_ylabel('Stock / Index value (relative)')

plt.savefig('images/02_sp500_gsn_norm.png')

plt.show()

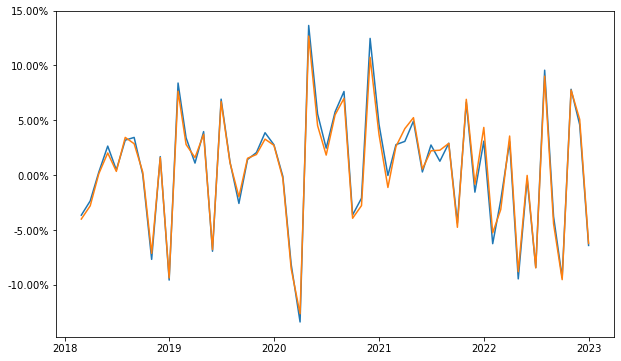

rf = pd.read_excel('data/FF_monthly.xlsx', index_col=0, parse_dates=True)

rf = rf.resample('M').last()

rf = rf.loc[start_date:]

rf = rf / 100

df = df.resample('M').last()

rets = df.pct_change().dropna()

rets = pd.concat([rf, rets], axis=1)

rets.dropna(inplace=True)

rets['SP500_excess'] = rets['SP500'] - rets['RF']

fig, ax = plt.subplots(figsize=(10, 6))

ax.plot(rets['Mkt-RF'])

ax.plot(rets['SP500_excess'])

vals = ax.get_yticks()

ax.set_yticklabels(['{:,.2%}'.format(x) for x in vals])

plt.savefig('images/02_market_excess_return')

plt.show()

cov_matrix = rets[['GS.N', 'SP500_excess']].cov()

cov_value = cov_matrix['GS.N']['SP500_excess']

var_value = rets['SP500_excess'].var()

beta = cov_value / var_value

print('Beta: ', round(beta, 4))

Beta: 1.4153

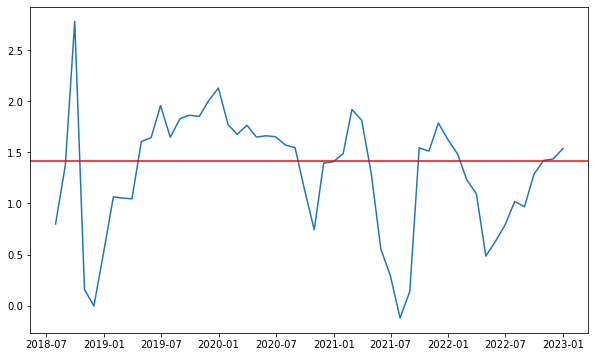

Rolling window#

rets['cov6M'] = rets.rolling(6).cov().unstack()['GS.N']['SP500_excess']

rets['var6M'] = rets['SP500_excess'].rolling(6).var()

rets['beta6M'] = rets['cov6M'] / rets['var6M']

plt.figure(figsize=(10,6))

plt.plot(rets['beta6M'])

plt.axhline(beta, color='r')

plt.savefig('images/02_rolling_beta.png')

plt.show();